1. Why Long-Short Vs Long Only

1.1 Structural Downside Protection

Long-only portfolios remain fully exposed to market beta. In contrast, Long–Short strategies dynamically manage net exposure and can increase short positioning during deteriorating market conditions.

Historical stress periods demonstrate materially lower drawdowns:

• Gulf War (1990) : S & P – 14.69 % vs Long – Short + 5.10 %

• Russian Default (1998) : – 15.37 % vs – 8.27 %

• Dot-Com (2000–02) : – 44.73 % vs – 10.30 %

• Global Financial Crisis (2007–09) : – 50.95 % vs – 30.57 %

Lower capital impairment directly improves long-term compounding efficiency.

1.2. Faster Capital Recovery

Large drawdowns require disproportionately larger gains to recover.

Post-2008:

• By April 2010, S & P remained – 18.85 % below peak

• Long – Short was only – 6.96 % below peak

Reduced peak losses translate into faster recovery cycles.

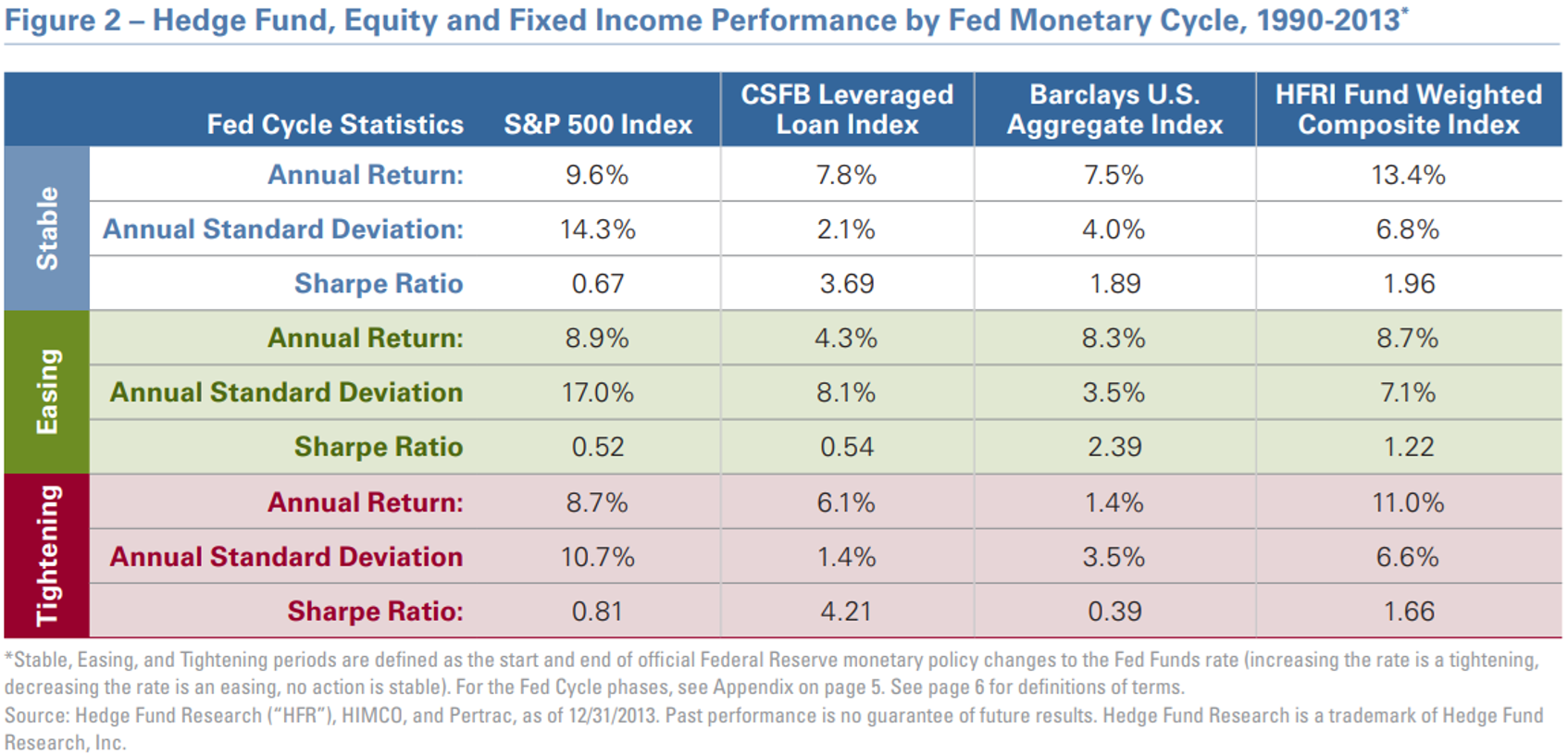

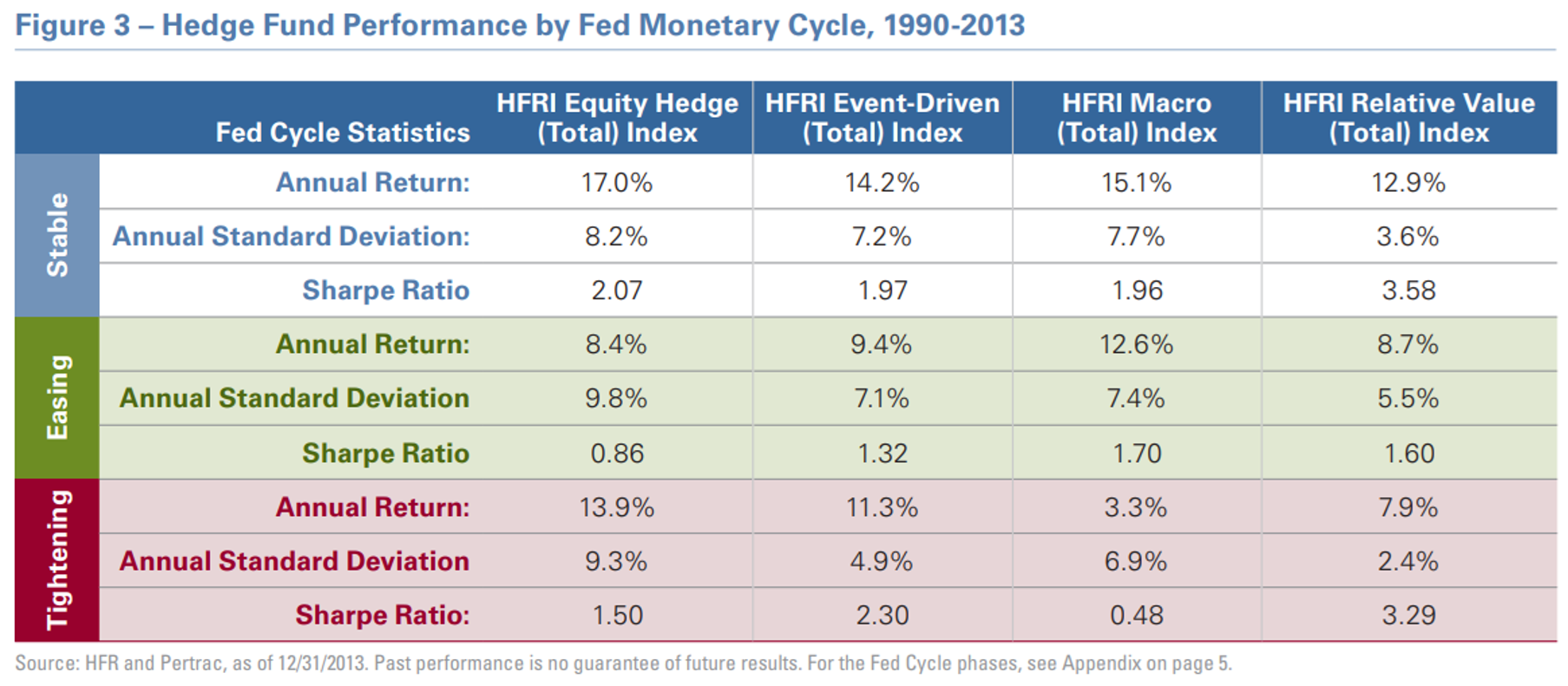

1.3. Superior Risk-Adjusted Returns

In stable interest-rate environments:

• S & P 500 Sharpe : 0.67

• Equity Hedge Sharpe : 2.07

Nearly 3x improvement in risk-adjusted efficiency.

In tightening cycles, Long–Short strategies outperformed equities across return, volatility, and Sharpe metrics.

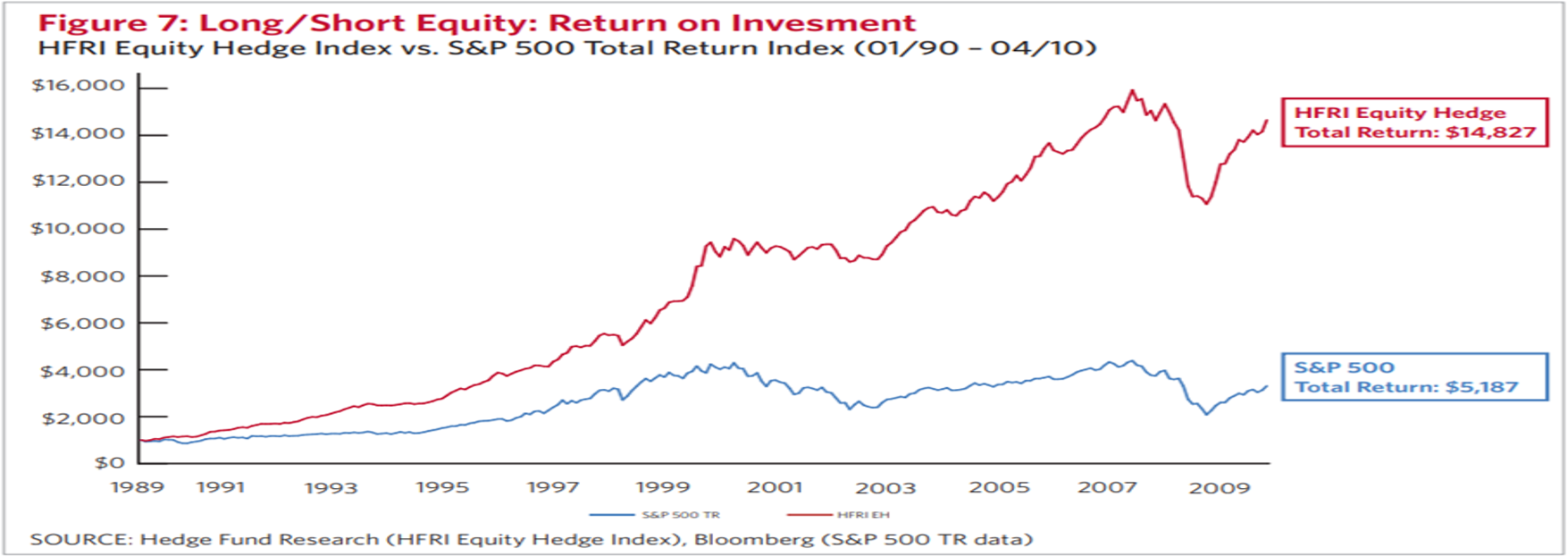

1.4 Long-Term Compounding (1990–2010)

- HFRI Equity Hedge : + 1,383 %

- S & P 500 Total Return : + 419 %

- $1,000 invested : $ 14,827 vs $ 5,187

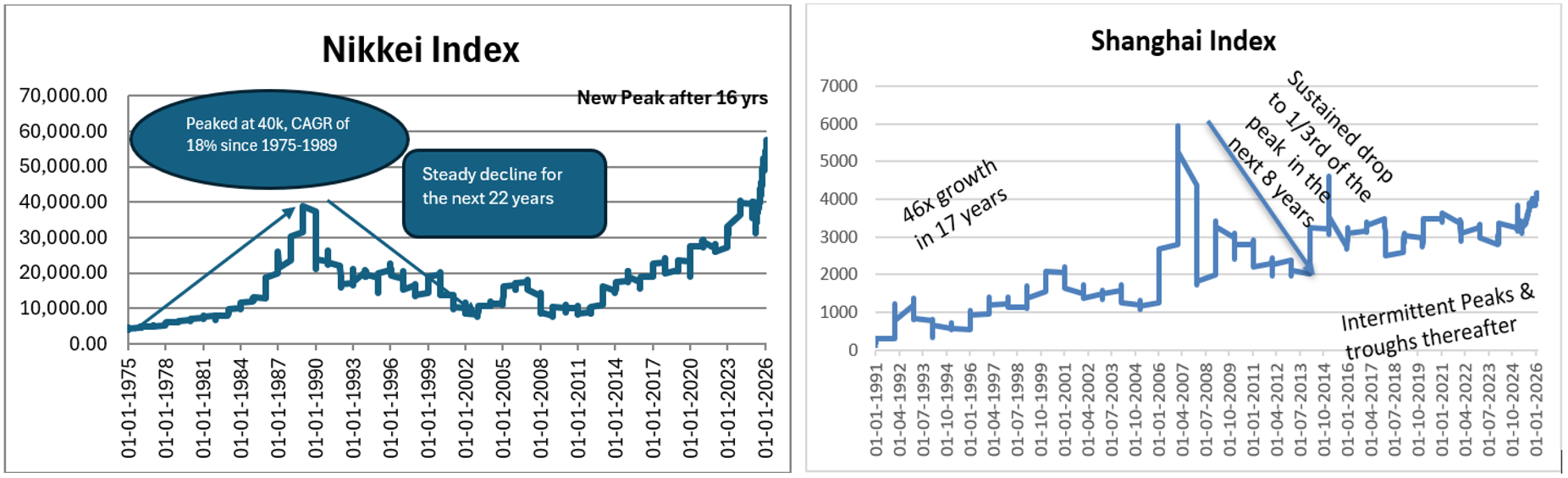

1.5 Markets Move in Cycles

We studied long-term price patterns of major global indices. The evidence is clear: peaks and troughs can last far longer than investors expect.

Nikkei 225

- Peaked in 1990 after an economic boom

- Entered a prolonged collapse

- Regained its 1990 high only in 2025 — a 35-year recovery

Shanghai Composite

- ~25 % CAGR for 17 years

- Followed by a 67 % decline over 8 years

1.6 Long Short Equity (Equity Hedge) Under Different Monetary Cycles : A Comparative Framework

Post-2008, with unprecedented monetary easing, investors questioned whether hedge fund returns were structurally constrained. The key issue now is how Long–Short strategies perform across different rate environments.

The data shows:

- Long/Short equity outperforms equities in stable and tightening rate cycles.

- It keeps pace during easing periods.

- It delivers superior risk-adjusted returns across most macro regimes.

For investors reallocating from fully valued equities and low-yielding fixed income, Long–Short Equity provides a structurally advantaged, diversified return stream with improved downside control.

2. Aksa Portfolio Performance Over Cycles

2.1 Six-Year Performance Overview

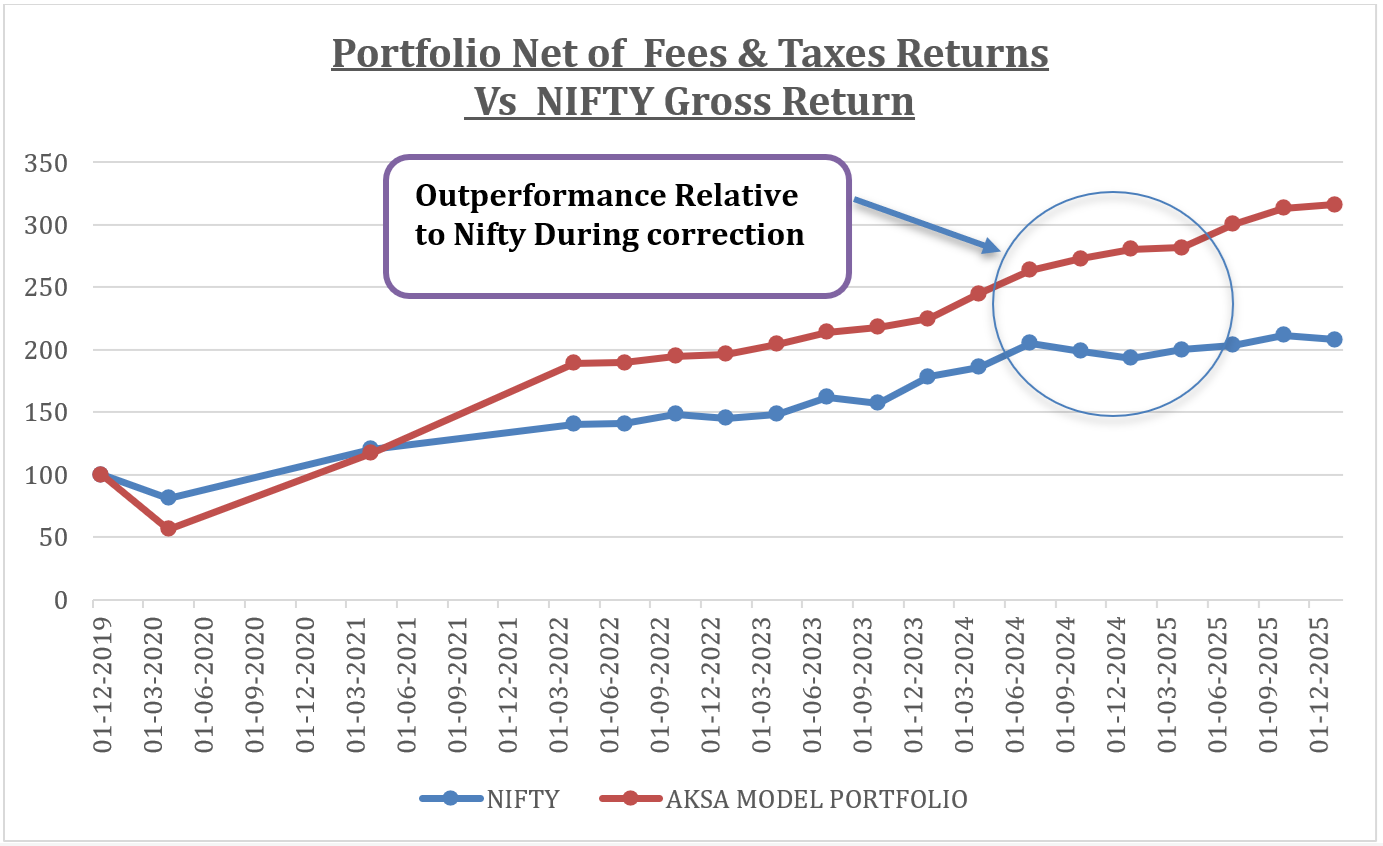

Over the six-year period from December 2019 to December 2025:

- AKSA Model Portfolio (Net Returns): ~215% cumulative return

- NIFTY (Gross): ~105% cumulative return

- Absolute Outperformance: ~110 percentage points

The portfolio generated materially higher wealth creation across a full market cycle that included:

- COVID-led drawdown (2020)

- Liquidity-driven rally (2021)

- Global tightening (2022)

- Correction regime (Sept 2024–Mid 2025)

The return profile reflects structural alpha generation rather than cyclical beta exposure.

2.2 Performance During the Market Correction

(Mid-September 2024 – Mid-2025)

During the recent correction phase:

- The NIFTY experienced drawdown and elevated volatility

- The AKSA Model Portfolio demonstrated relative capital stability

- The portfolio delivered measurable outperformance during stress

Key characteristics observed:

- Lower peak-to-trough drawdown relative to index

- Reduced participation in downside beta

- Faster normalization and recovery trajectory

- Preservation of prior gains

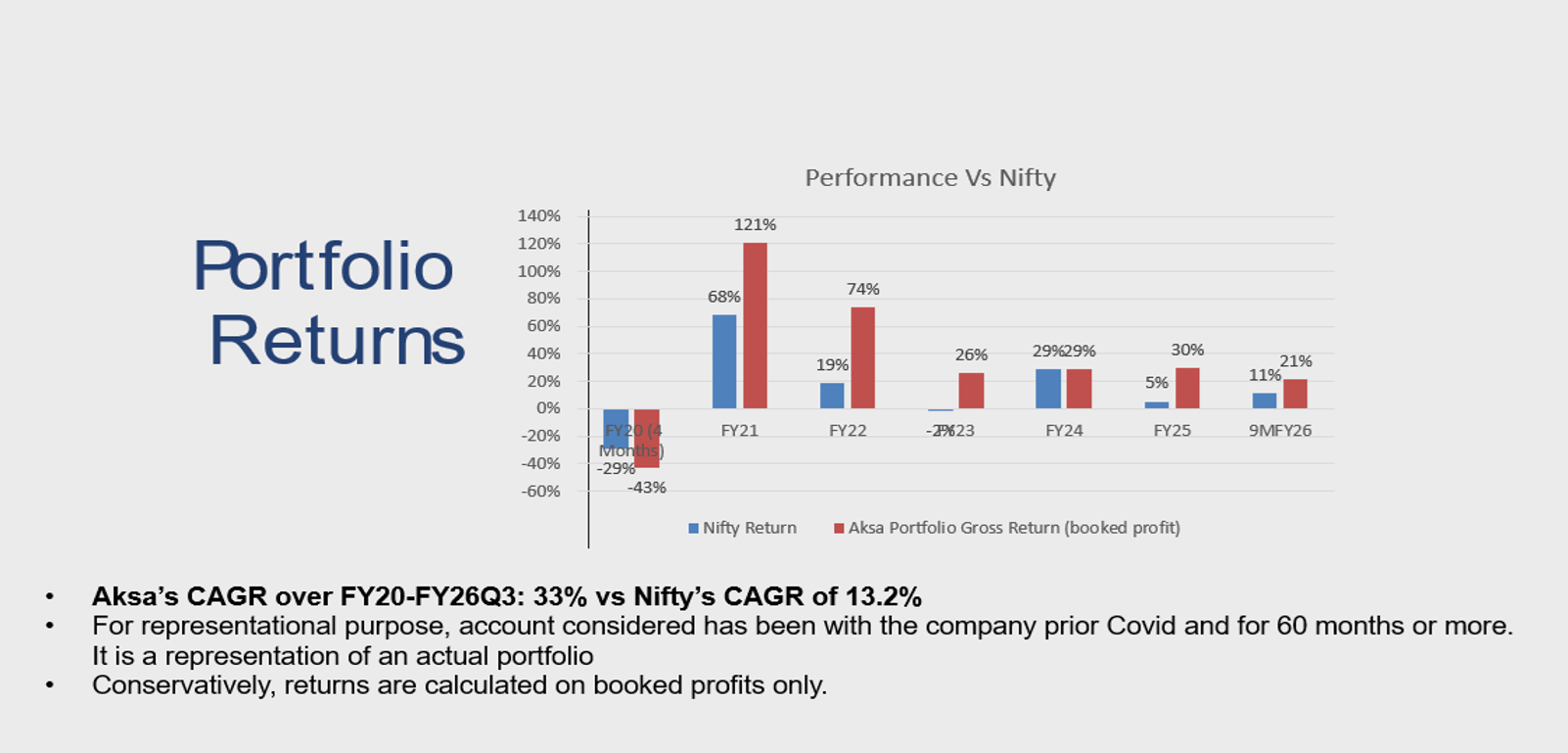

Annual Performance

Performance from 01-Dec-2019 till 31-Dec-2025

- Aksa Gross Cagr Return : 33.0 %

- Nifty Gross Cagr Return : 13.2 %